michigan gas tax increase 2021

If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon. As such a 45-cent increase would bring Michigans total average gas tax to 8913 cpg by far the highest in the nation and over 30 cents higher than in Pennsylvania which currently has the highest gas tax 587 cpg.

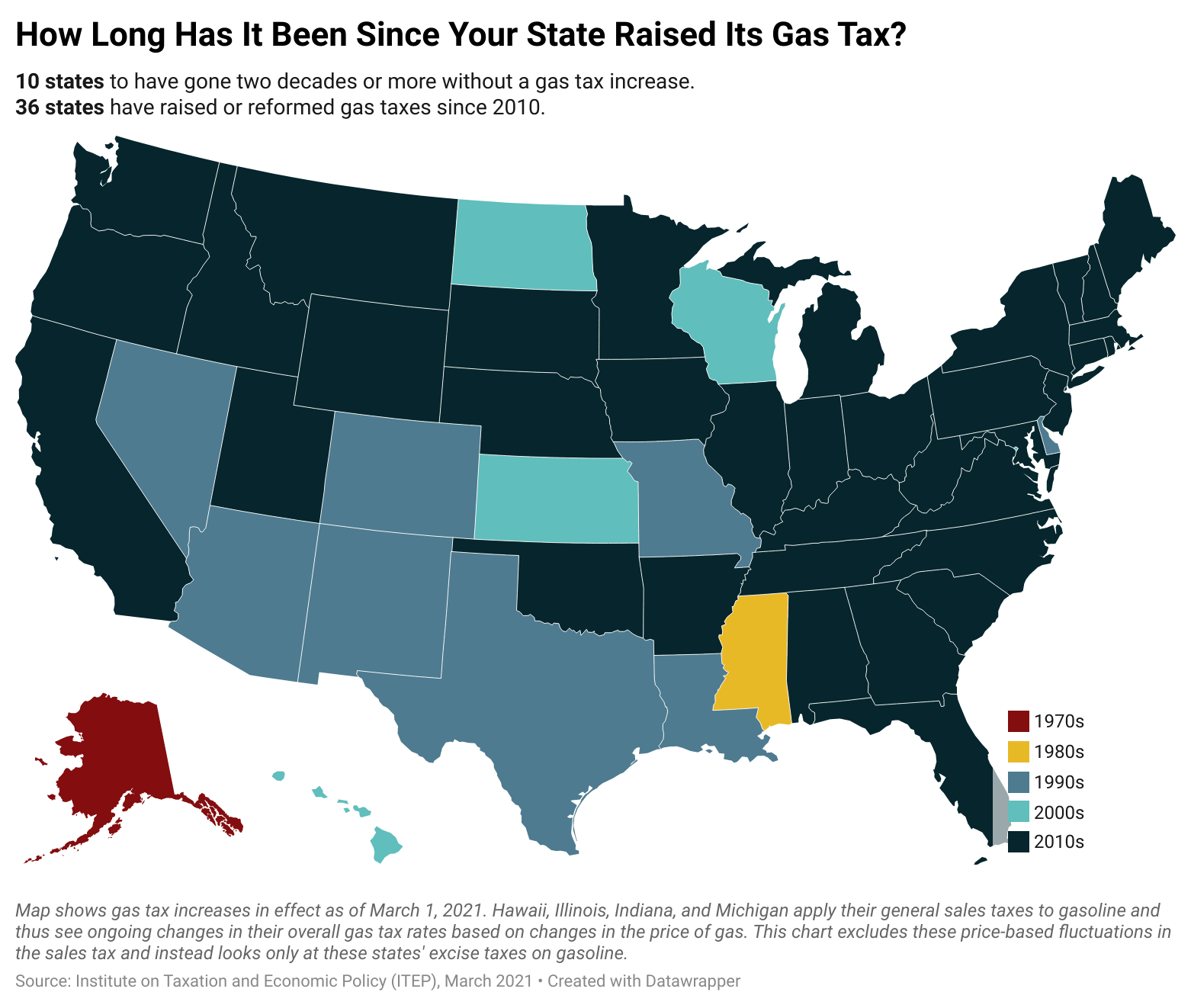

How Long Has It Been Since Your State Raised Its Gas Tax Itep

The tax rates for Motor Fuel LPG and Alternative Fuel are as follows.

. To increase the state gasoline and diesel taxes to between 23 cents and 30 cents per gallon depending on the wholesale price of these fuels. Fuel producers and vendors in Michigan have to pay fuel excise taxes and are responsible for filing various fuel tax reports to the Michigan government. Eubanks said the net tax increase to about 250000 pass-through businesses and their owners in Michigan would be about 105 million after accounting for federal tax benefits worth an estimated 175 million.

The Center Square A group representing convenience stores across Illinois is eyeing litigation over a looming state requirement to place stickers on gas pumps announcing a delayed tax increase. Before the official 2022 Michigan income tax rates are released provisional 2022 tax rates are based on Michigans 2021 income tax brackets. Gretchen Whitmer proposed a large tax hike.

The new tax will increase the price of regular by six-tenths of a cent which will bring the state gas excise tax to 511 cents per gallon. Florida gas tax totals at 265 cents per gallon. 1 2020 an action she said would raise more than 2 billion annually to fix.

Gas prices have gone up in Michigan now that the state tax on gas jumped from 19 cents to 263 cents per gallon. Gasoline Diesel Fuel and Liquefied Petroleum Gas taxes recodified. LANSING Gov.

Diesel Fuel 263 per gallon. Michigan Gas Tax Increase on Audacy. 53 rows When you add up all the taxes and fees the average state gas tax is 3006 cents per gallon as of the beginning of 2021 according to the US.

Motor Fuels Taxes include the Gasoline Diesel Fuel and Liquefied Petroleum Gas and Motor Carrier Fuel Taxes. 3 hours agoA woman parks to fill up her vehicles gas tank at a Mobil gas station in Northbrook Ill Sunday March 21 2021. Gretchen Whitmer on Tuesday proposed raising Michigans gas tax by 45 cents per gallon by Oct.

In addition to state gas taxes which can make up between 5 percent and more than 20 percent of the cost of gas the federal government levies a tax of 184 cents per gallon 247. Fee Current amount Amount as of 01012022 Hybrid registration fee 100 100 Hybrid registration gas tax 17 20 Total amount 117 120 Electric vehicles. Florida had tried to remove the gas tax altogether way before the price increases back in November 2021.

Increased Gasoline Tax rate to 19 cents per gallon. 4198 cents per gallon 140 greater than national average 2021 diesel tax. For fuel purchased January 1 2017 and through December 31 2021.

These motor fuel taxes dont include the states 6 sales tax or the federal tax of 184 cents per gallon. LPG tax is due on the 20th of April July October and January Quarterly tax except for motor fuel suppliers 20th of each month. The amount an individual companys business taxes would increase would depend on its annual income.

Diesel Fuel 272 per gallon. For fuel purchased January 1 2022 and after. The current state gas tax is 263 cents per gallon.

A 45-cent tax increase per gallon of gas. Listen to Free Radio Online Music Sports News Podcasts. The current gas and diesel tax rates are 19 cents and 15 cents per gallon respectively.

The 2022 state personal income tax brackets are updated from the Michigan and Tax Foundation data. Hybrid registration gas tax 17 20 Total amount 47 50 o For vehicles that weigh more than 8000 pounds the hybrid registration tax will increase from 17 to 20. 4318 cents per gallon 141 greater than national average Total gasoline use.

For the 2021 income tax returns the individual income tax rate for Michigan taxpayers is. Gasoline 263 per gallon. Michigans total gas tax the 27-cent excise tax and the 6 sales tax was the 11th highest in the nation in 2021 behind states such as.

Michigan tax forms are sourced from the Michigan income tax forms page and are updated on a yearly basis. Increased Motor Carriers Fuel Tax rate to 21 cents per gallon with 15 cent credit for fuel purchased in Michigan. This booklet contains information for your 2022 Michigan property taxes and 2021 individual income taxes homestead property tax credits farmland and open space tax relief and the home heating credit program.

DeSantis proposed that the gas tax should be waived but didnt happen. 4862405 gallons 4381530 highway 480875 nonhighway. As of January of this year the average price of a gallon of gasoline in Michigan was 237.

Taxes on diesel have gone up too going from 14 cents a gallon to 263 cents. Gasoline 272 per gallon. It will have a 53 increase due to a rounding provision specified in the calculations.

If by the end of September the annual inflation rate ends up similar to that of the previous six years the gas tax would rise from 263 cents to. Michigan Fuel Tax Reports. Michiganders would be paying double the state taxes they currently pay at the pump.

At the time of writing this article it remains that way and Florida continues to collect taxes at the pump. Throw in the 184. And the states gas tax as a share of the total cost of a gallon of gas stood at 177 percent.

Talking Michigan Taxes. Potential Increases and Reforms in 2021 Mackinac Center Policy Forum Virtual Event At the beginning of the last legislative term Gov. The tax on diesel will increase by four-tenths of a cent to 389 cents.

Alternative Fuel which includes LPG 263 per gallon.

Michigan Gasoline Prices Increase Another 21 Cents Monday State Abc12 Com

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential

Michigan Gas Tax Hike Coming In 2022

U S States With Highest Gas Tax 2022 Statista

How Long Has It Been Since Your State Raised Its Gas Tax Itep

House Approves 6 Month Pause Of Michigan S 27 Cent Per Gallon Gas Tax

Michigan Republicans Announce Plan To Suspend State Gas Tax For Next 6 Months

Michigan S Gas Tax How Much Is On A Gallon Of Gas

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Nationwide Gas Prices Hit All Time High Michigan Prices Nearing State Record Mlive Com

.png)

Map State Gasoline Tax Rates Tax Foundation

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Michigan Gas Prices Hit 2021 High Here S Where It S Most Expensive In The State

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

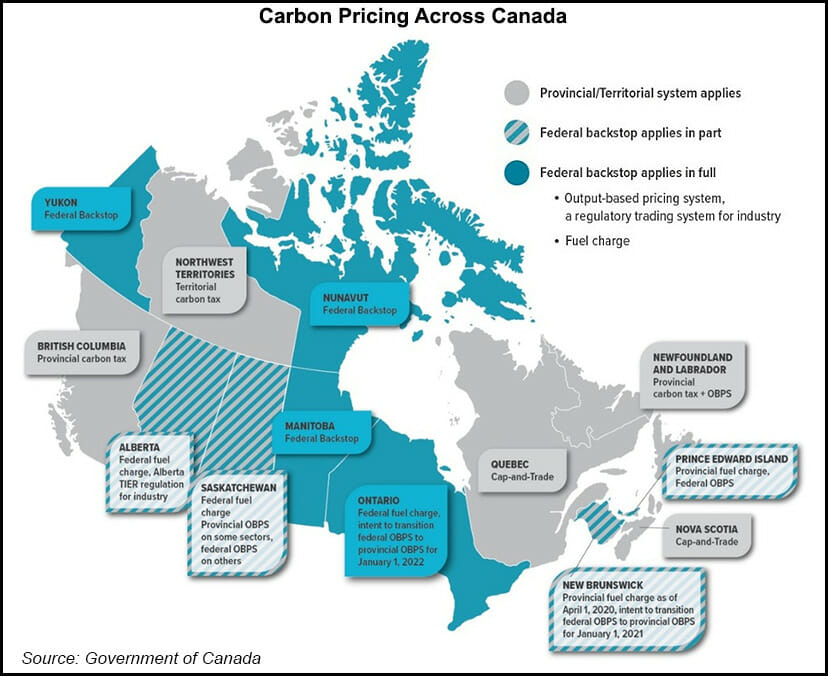

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence

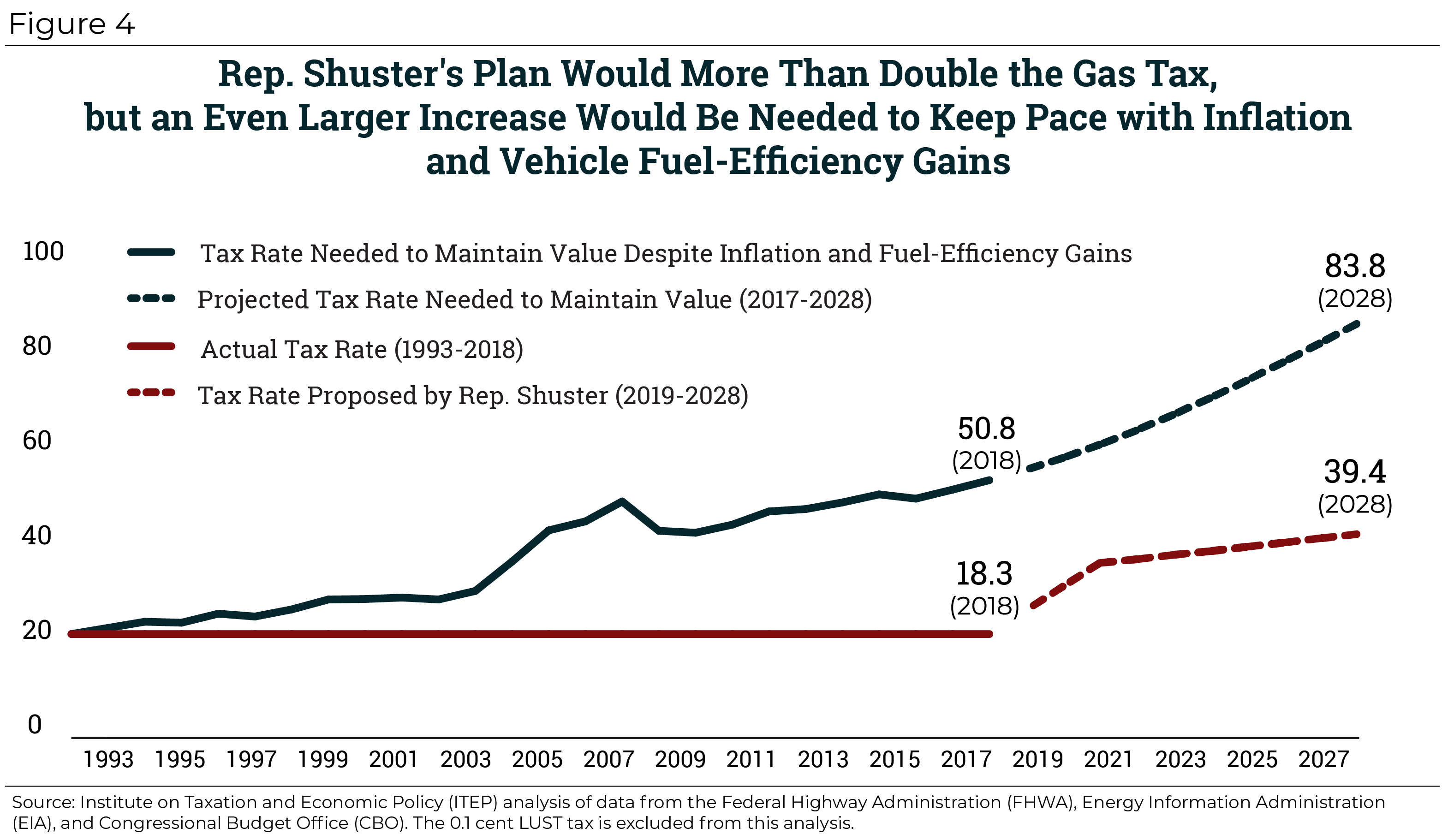

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Michigan Gas Prices Rose 42 Cents In One Week Hitting Highest Peak In Years Mlive Com